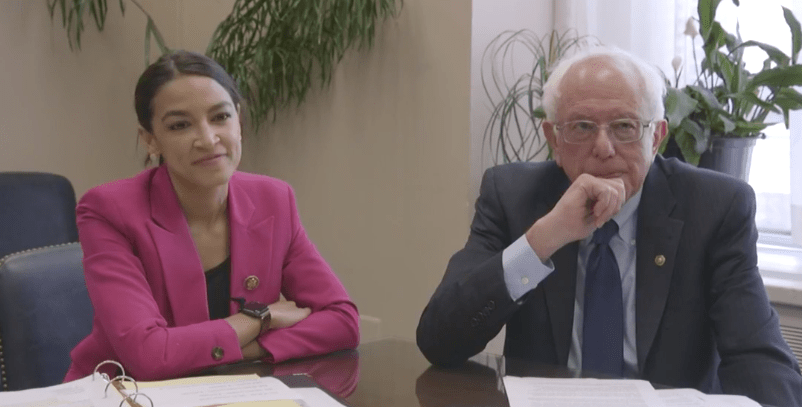

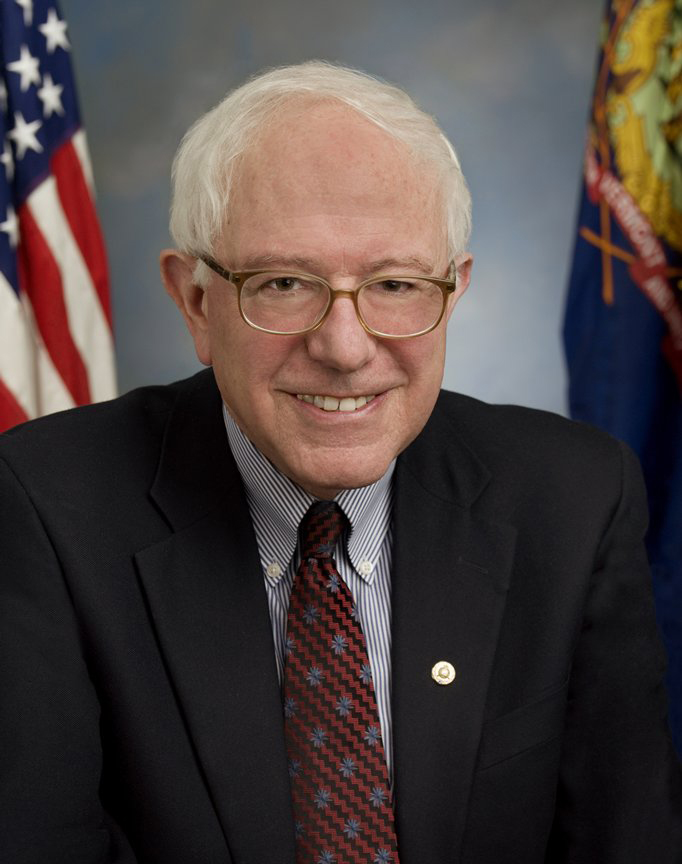

Last week U.S. Sen. Bernie Sanders (I-Vermont) and U.S. Rep. Alexandria Ocasio-Cortez (D-Jackson Heights) streamed their plan for The Loan Shark Prevention Act live on Twitter.

The two-page bill would cap the interest rates on credit cards and consumer loans at 15 percent, which is similar to the interest rate cap that Congress issued 40 years ago, according to the legislation.

“Some of you may have noticed that there was a Federal Reserve report that came out just a few days ago,” said Sanders on May 9. “What it said was that the bottom half of the American people – 50 percent of the American people have zero in wealth. That means they have nothing in the bank.”

Earlier this month, the Board of the Governors of the Federal Reserve System released a 60-page report that depicted consumer credit rising roughly five percent in 2018 and standing at $4 trillion.

“One-third of total debt owed by households, commonly referred to as consumer credit, consists mainly of balances of student loans, auto loans, and credit card debt,” according to the report.

Student loans were the most problematic of the three aforementioned loans, according to the report.

“Delinquency rates on those loans remain high relative to historical standards,” according to the report. “Although the risks posed to the broader financial system appear limited, as the majority of student loans were issued through government programs, the elevated student loan balances and delinquency rates highlight the challenges associated with debt burdens faced by some households.”

The average household has $15,000 in credit card debt, while $178 billion was generated in interest fees and fines from credit card companies. The average interest rate on retail credit cards is 27 percent and the average maximum credit card interest is 24.98 percent, according to The Loan Shark Prevention Act.

“This to me is not just an economic issue, it’s a moral issue,” said Sanders. “Wall Street and credit card companies are charging people outrageously high-interest rates when they are desperate and they need money to survive.”

Ocasio-Cortez believes this is an issue that all Americans from different backgrounds can agree on.

“When we talk about coming together to solve our problems as a country, this is one of the best ways that we can come together,” said Ocasio-Cortez. “These predatory loans and high-interest rates impact rural communities, they impact urban communities like those I represent.”

Despite how densely populated the Bronx and Queens neighborhoods like Jackson Heights, Corona, East Elmhurst, Elmhurst and Woodside are Ocasio-Cortez said that she noticed that lower-income communities like the ones she represents have fewer banks than other neighborhoods.

“It’s not just access to capital [that is a problem], but the ability to go somewhere and cash a check can be very difficult whether you are in a rural part of the country or even in certain urban neighborhoods.”

Payday loans, a short-term and high-cost loan, was banned in New York, but Ocasio-Cortez finds that regular banks are slowly replacing them with their ever-increasing interest rates.

“Essentially your credit card becomes a payday loan,” said Ocasio-Cortez. “We should not be using people’s misfortune, using people’s income status as a basis for extortion and a basis for predatory lending.”