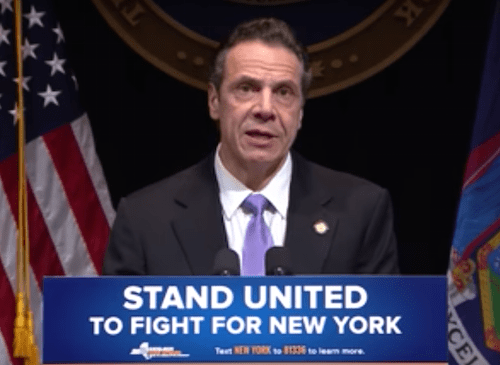

Governor Andrew Cuomo yesterday proposed a $168 billion fiscal year 2018-19 state budget, up about 2% from last year’s $164.5 billion spending plan.

Cuomo called the budget outline an “economic transformation plan” to ease the burden of the newly passed federal tax legislation.

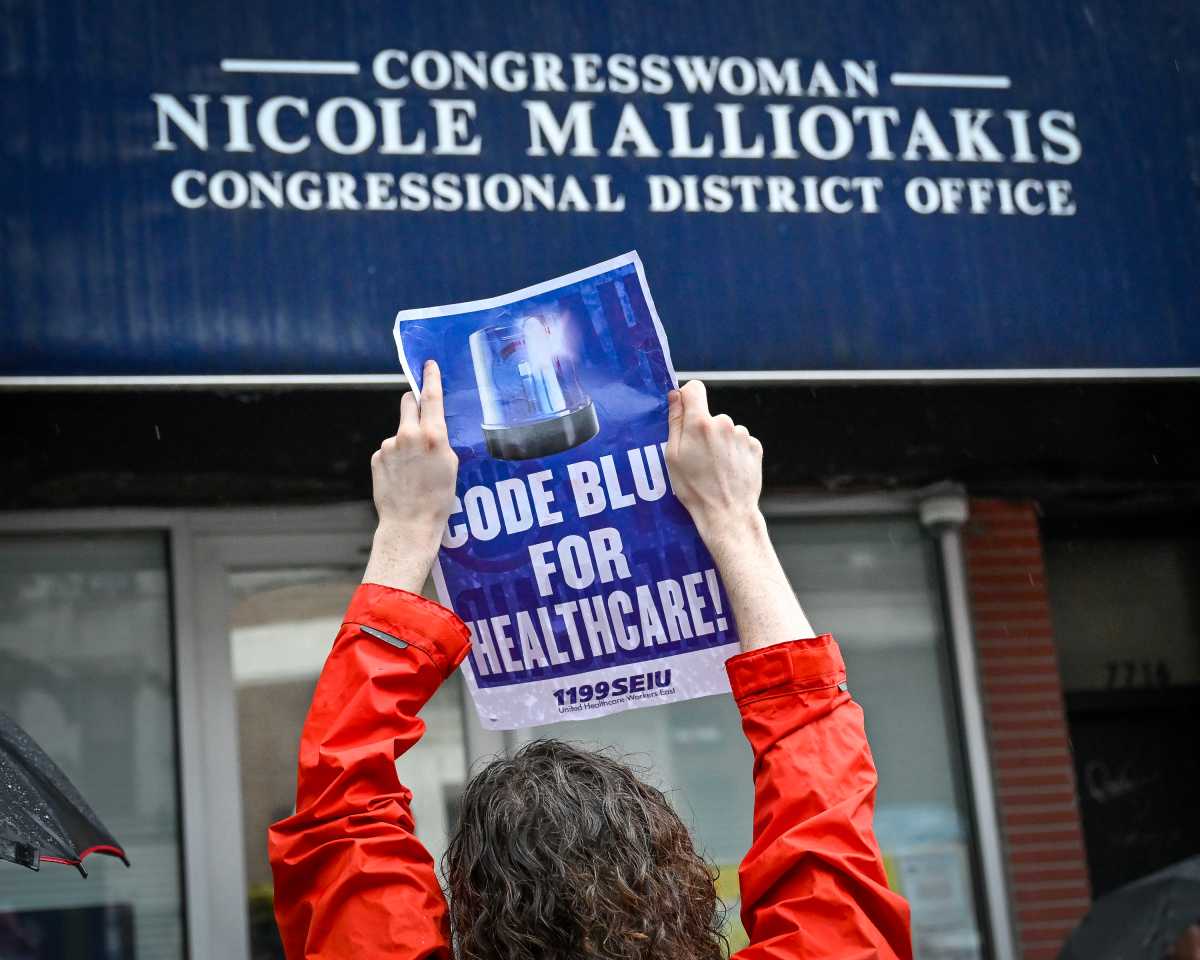

Already facing a $4.4 billion deficit and a reduction of federal healthcare spending, New York could see additional costs of more than $14 billion, resulting from the federal tax plan’s cap on state and local tax deductions, according to Cuomo.

The governor, who is seeking reelection in November, and possibly a bid for the presidency in 2020, proposed shifting non-federally deductible income taxes on individuals to a statewide payroll tax on businesses, which could then write that cost off their federal tax bill. Wage earners would then avoid being taxed by the federal government on money that has already taxed by the state.

In fact, being paid income after it has been taxed by the state could theoretically bring individuals into a lower federal tax bracket, and owe less money to the federal government, “which would be a cruel but welcome irony,” Cuomo said.

Additionally, Cuomo broached the idea of creating charitable funds to allow federally deductible donations for causes such as healthcare and education in the state.

These measures are meant to combat the damage done to New York by the actions of federal lawmakers, who are using “California and New York, primarily, as the piggy bank to finance tax cuts for other states,” said Cuomo.

Yet even with these proposals, New York enters an uncertain time for its economy. Cuomo spoke of the need to raise revenue in a responsible manner, invest in healthcare and education, and provide relief for the middle class.

Cuomo’s proposed budget calls for a 3% increase in education spending, doubling the previous 1.5% growth cap, as well as a 3.2% increase on healthcare expenditure.

The executive budget also includes $836 million for the Subway Emergency Repair Plan, a sum which Cuomo wants the Nerw York City government to match. Long term funding for the MTA’s subway repair efforts, Cuomo suggested, could come from congestion pricing, a fee for driving in a certain area at a particular time.

Cuomo also reaffirmed his promise to deliver on his middle class tax cuts, although details were slim.

Overall, the proposal calls for total state taxpayer funded spending to be limited to 1.9%, below the self-imposed cap of 2%.

The proposal calls for revenue raisers across specifically targeted economic segments, such as imposing a tax hike on health insurance companies, which saw a 40% corporate tax cut resulting from the federal tax bill. Cuomo also suggested a one-year deferment on benefits from the tax bill on all corporations who stand to gain over $2 million, which could raise an additional $300 million in total revenue for the state.

Additional revenues would be raised though added taxes on prescription opioids, as well as an “internet fairness conformity” tax, which would require online vendors to collect sales tax. Mr. Cuomo also reiterated his call for closure of the carried interest loophole, a task which he said would require cooperation of neighboring states.

Generally, the governor used his speech to both outline his vision for New York in wake of the newfound uncertainty, while taking aim at the nation’s Republican controlled capital as he heads for reelection. “Washington hit a button and launched an economic missile and it says ‘New York’ on it, and it’s headed our way,” he said. “You know what my recommendation is? Get out of the way.”

Albany will debate the budget proposal in the comings months, as lawmakers hope to reach a final budget resolution by April 1.