The U.S. House of Representatives today passed the Build Back Better (BBB) plan, which spends $2 trillion on social services and an array of recovery facets.

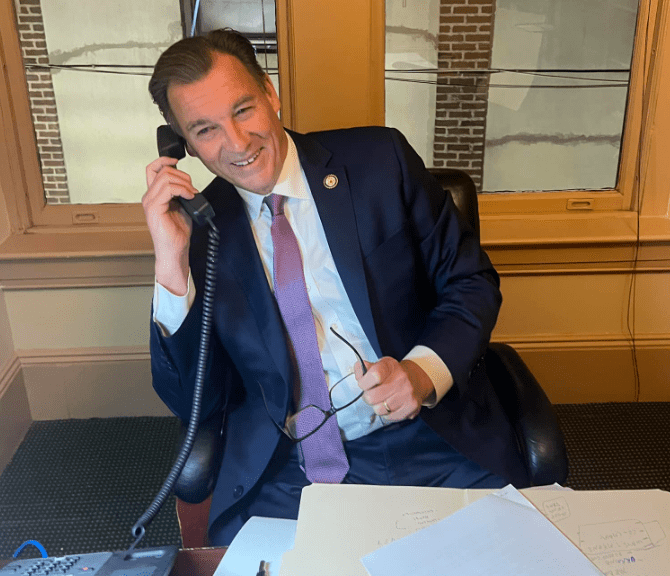

Congressman Tom Suozzi (D-Long Island/Queens) held a virtual press conference shortly after the vote to discuss the main points of the bill he wanted to celebrate—mainly the cap on the state and local tax (SALT) deduction.

Suozzi has been fighting for an increase in the amount of tax deductions for state property owners since it was capped at $10,000 by former President Donald Trump. Before the cap was instituted, residents in high-taxed states like New York could write off all their state property taxes from their federal taxes.

In September, the congressman confirmed that he would not support Biden’s bill unless it repealed the SALT cap. In the house version of BBB, the cap will be increased from $10,000 to $80,000 from 2021 through 2030 before dropping it back to $10,000 in 2031.

“You decide how you want to run your local governments. And we’re not going to interfere with that. We’re going to give you a deduction so you’re not taxed on the taxes you’ve already paid,” Suozzi said.

New York Democrats in the House are touting a number of other wins this Friday. Congresswoman Nydia Velázquez (D-Brooklyn/LES) noted the $811 billion in the measure addressing multiple issues for working families.

“It expands the basic promise of free schooling in America for the first time in 100 years with universal preschool for all 3- and 4-year olds; slashes families’ child care costs; extends the landmark Biden Child Tax Credit; and expands access to affordable home care for older adults and those with disabilities,” Velázquez said.

Congressman Jerry Nadler (D-Manhattan/Brooklyn) said that BBB will bring transformational change to New York City. “By passing President Biden’s agenda into law, we have set our nation on a course to meet its climate goals, create millions of good-paying jobs, relieve working families struggling to afford the growing costs of raising children, and grow our economy,” he said.

He said the bill aims to reduce greenhouse gas emissions by 50%, and create a Civilian Climate Corps “which will employ generations of New Yorkers.”

BBB has been touted as the largest investment in climate change in the history of the U.S. Through the $555 billion of investments over 10 years, the Biden Administration plans to create hundreds of thousands of energy jobs.

Congresswoman Carolyn Maloney (D-Manhattan/Astoria/Greenpoint) secured her agenda in the Build Back Better bill as well, she noted in a statement. “And at my urging, the Build Back Better Act also provides $2.86 billion to the World Trade Center Health Program, which provides medical treatment and monitoring for more than 110,000 responders and survivors across the country – 2,800 of whom live in my district,” Maloney said.

The BBB will now move to the Senate where it will very likely go through several revisions, then must be passed and returned to the House for a final thumbs-up before going to Biden’s desk. It comes about two weeks after Biden signed the $1 trillion bipartisan infrastructure bill on Nov. 6.

Congressman Gregory Meeks (D-Queens) said that as the state recovers from the worst of the pandemic, there are still struggles in the workplace when it comes to securing a living wage and that the infrastructure bill taken together with Build Back Better will mitigate this.

“We are still experiencing the impacts of a pandemic economy, and together, the Bipartisan Infrastructure Bill, which was recently signed into law, and the Build Back Better Act will bring more Americans into the labor force and increase the supply of good-paying jobs. These are necessary investments to creating a foundation for strong economic growth,” Meeks said.