State Sen. James Sanders Jr. (D-Queens) on Sept. 1 introduced legislation to help stop unjust home foreclosures due to a recent State Court of Appeals decision.

The Freedom Mtge. Corp. v Engel (2021) decision allows banks, as mortgage lenders, in foreclosure actions to unilaterally reset the 6-year statute of limitations period by determining that a voluntary discontinuance acts as a revocation of the acceleration of the debt.

Banks are now the only plaintiffs in New York State that are essentially exempt from the statute of limitations.

As a direct result of the court decision, a flurry of motions has been filed by mortgage lenders and servicing institutions to reopen time-barred cases that were dismissed years ago on the grounds there is a new change in the law.

Sanders’ bill ensures the statute of limitations applies to all parties equally without exemption.

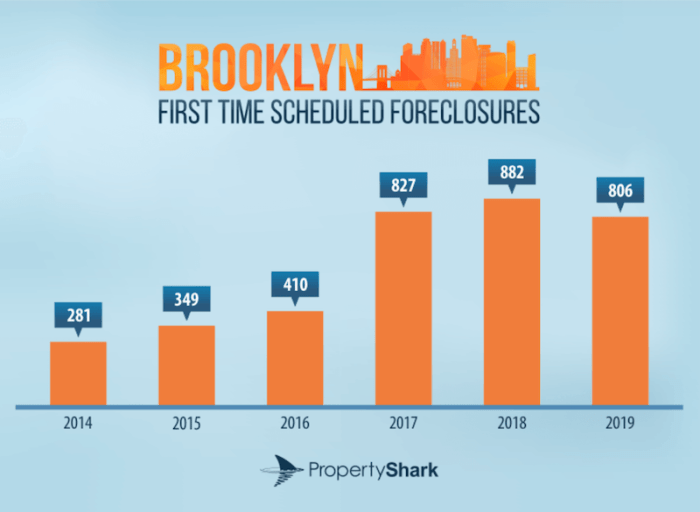

“Given the state of the economy during the COVID-19 pandemic, and even before that, Southeast Queens has been hit with a barrage of home foreclosures. The New York State Court of Appeals ruling earlier this year has even made matters worse by giving mortgage lenders an undue advantage over homeowners in court proceedings. My legislation would ensure a fair process during foreclosure cases and prevent many foreclosures,” said Sanders.

Sanders’ measure would stop banks from resetting the statute of limitations period with a voluntary discontinuance, and prevent banks from suing a homeowner for a money judgment on a note when the mortgage has been determined to be time-barred because the statute of limitation expired.

The bill would also limit a bank from using this statute to recommence a new action within six months of the statute of limitations expiring only once.

The measure has already drawn wide support from Sanders’ colleagues in the Senate.

“It is imperative that we work together in order to keep New Yorkers in their homes,” said State Sen. Joseph P. Addabbo Jr. (D-Queens). “The COVID-19 pandemic has left many homeowners unsure of how they would be able to pay their mortgages. I am proud to be a co-sponsor on this piece of legislation that, if made into law, will help ensure that the laws are applied equally to everyone.”

Sen. Robert Jackson (D-Manhattan) also co-sponsored the measure to protect New York homeowners from the destructive whim of the lending industry.

“Banks can’t play fast and loose with New Yorkers’ homes, and this bill will ensure that homeowners can count on some basic protections like not getting dragged back into foreclosure actions the banks themselves had voluntarily tabled before,” said Jackson.

Assemblymember Latrice Walker (D-Brooklyn) introduced the legislation on the lower chamber side with strong support from Assemblymember Rodneyse Bichotte Hermelyn (D-Brooklyn).

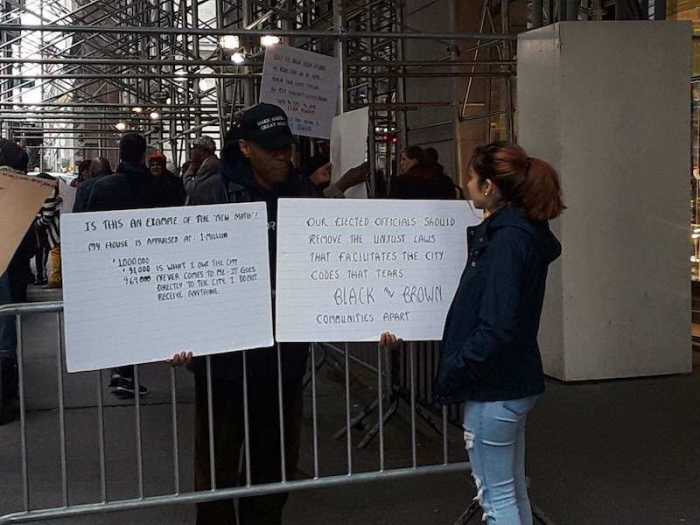

“The risk of displacement, particularly to seniors and in communities of color must not be pushed aside. As the Delta variant spreads, we need to keep New Yorkers safe. I am proud to co-sponsor Sen. James Sander’s and Assemblymember Latrice Walker’s bill to stop unjust foreclosures. Keeping people in their homes is a priority that needs to be at the front of our agenda this legislative session,” said Bichotte Hermelyn.

The bill still needs to be passed by both chambers before heading to Gov. Kathy Hochul’s desk for a final signature.