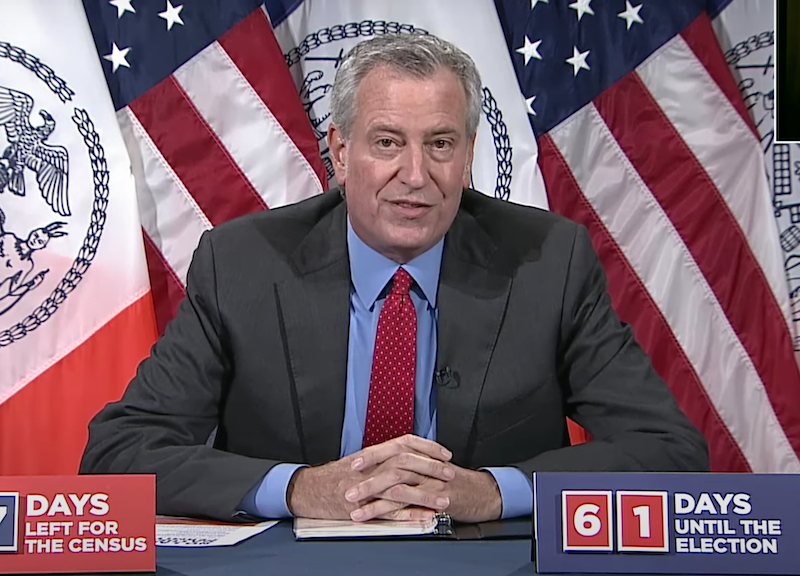

Despite an outcry from Brooklyn electeds and NHS Brooklyn, a borough non-profit that helps residents buy, repair and keep their homes, Mayor Bill de Blasio said yesterday the city will go ahead with its annual tax lien sale today.

A tax lien, explained the city’s Department of Finance (DOF) and Housing and Preservation Development (HPD) experts in a PowerPoint, is a “legal claim against real property for unpaid property taxes, water and sewer charges, and other property-related municipal charges, including the interest due on these charges.”

When the debt is delinquent, the city is allowed to sell the debt through a non-profit bank trust that sells liens, not the property. The Trust pays the city upfront for the debt and hires an authorized debt collector to get money from the homeowner.

More than 3,000 liens citywide on single to three-family homes are set to be sold today. As reported and argued with documentation in a KCP op-ed yesterday the great majority of these lien sales are Brooklyn neighborhoods of color and with high poverty rates, and the sales could greatly contribute to displacement and gentrification.

Wednesday, NHS Brooklyn and a number of Brooklyn lawmakers including State Senators Roxanne J. Persaud and Kevin Parker; Assemblymembers Rodneyse Bichotte and Mathylde Frontus; and City Councilmembers Alicka Ampry-Samuels, Inez Barron and Farah Louis hosted a Virtual Lien Sale Outreach Session to inform homeowners about the lien sale process.

“Our intent is for everyone to remain in their homes. We do not want to see anyone losing their homes,” said Persaud on the virtual call.

“This is a last-ditch effort to get people who are on the lien sale to either make payment or enter into agreement,” stressed Angella Davidson of NHS of East Flatbush, Inc.

Davidson said the deadline to pay a lien or set up a payment plan was yesterday, Sept. 3. The experts in the session encouraged people to reach out and set up a payment agreement for bills, such as water liens, property taxes, and emergency repairs that usually apply to rental properties.

Lastly, the virtual meeting pointed out that Local Law 45 of 2019, gives the city the authority to make three payment plans for eligible applicants to defer property tax and interest. Eligibility criteria states that the property must be owner-occupied and the annual income of owners must be $58,399 or less to apply for the low-income senior, fixed-term income-based, or extenuating circumstances income-based payment plans.

The virtual meeting came less than a week after Attorney General Letitia James and 57 of Brooklyn’s electeds plead in an Aug. 30 letter to De Blasio that stated: “On behalf of New Yorkers, and particularly those in communities of color, we write to strongly urge you to remove small homes from the 2020 New York City tax lien sale and abstain from selling such liens until the conclusion of the COVID-19 emergency. There are more than 4,700 small homes on the lien sale list. In the name of fairness and justice, the Commissioner of Finance must use the power given to them by law to remove properties from the lien sale at their discretion.”

AG James said that the fees and steep, compounded interest rates imposed by the tax lien sale on residents are “dramatic,” especially in a city facing financial hardships due to COVID-19. She wrote that majority Black and Brown homes on the list will either foreclose or be sold in a housing market under duress, and has called for reforms to the lien sale program before. She urged for the cancel of the sale immediately.

Brooklyn Legal Services Corp. Staff Attorney Alexander Knipenberg said if liens do get sold then the money homeowners pay will be a lot higher than the amount they will pay if they enter into an agreement with the city.

“Whoever buys it [liens] usually charges an exorbitant amount of interest. They require down payment, and the amount of time for repayment agreement is significantly less than with the city.”

Knipenberg said there are not many defenses unfortunately against a tax lien foreclosure and it will go through a lot faster than mortgage foreclosures.

However, at any point during the foreclosure action before the property is sold a person can enter a payment agreement but will have to pay more money, said Knipenberg.

– Clarissa Sosin contributed to this story