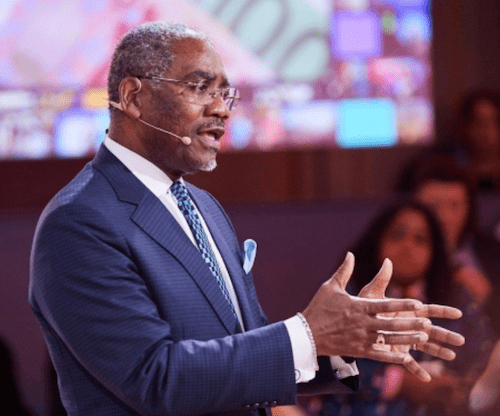

U.S. Rep. Gregory Meeks (D-Jamaica, Laurelton, Rosedale, Cambria Heights, Saint Albans, Springfield Gardens, The Rockaways, JFKAirport) this week released a policy plan establishing his priorities for coronavirus response legislation:

“Congressional response to the coronavirus pandemic must be immediate, and it must be comprehensive to utilize every aspect of industry and government capable of addressing the disruptions caused by this pandemic. Congress must provide substantial relief to families and small businesses in need of help, making it as fair as possible while reducing time consuming red tape. We must create incentives for retired health care professionals we’ll need to volunteer, encourage banks to offer forbearance and offer capital, and ensure that any government bailout of industry is conditioned on helping the workers hurt most by this crisis. Only through comprehensive and creative policy will we mitigate the worst health and economic consequences of coronavirus,” said Meeks.

The plan includes:

1. COST OF LIVING ADJUSTED UNIVERSAL TAX REBATE

A number of strong proposals have called for sending Americans direct deposits. We need to do this as soon as possible, and multiple payments are in order if the economy remains moribund. My plan makes two crucial adjustments to these proposals.

A. Cost of Living Adjustment – With more than half of confirmed cases in New York, the state has become the epicenter of the coronavirus outbreak. New York is also one of the most expensive places to live in the country. If there are no cost of living adjustments, any direct deposit plan would be worth less to the people getting hit the hardest. A COLA adjustment does not mean high cost areas would get more; it simply means they get the same include purchasing power parity. By adding a COLA adjustment, we increase fairness.

B. Means-Test After the Crisis (If at all) – Under the original Senate bill, a small business owner who had a banner year in 2018 but now has no income at all would get zero dollars. It is necessary that everyone gets their money now, and if there is to be means-test to that infusion, it should occur later during 2021 tax season. If we are to means test it should occur only when an individual exceeds a threshold income (~200K) in 2020.

2. IMMEDIATE MONEY AND RESOURCES FOR THE HEALTH CARE SYSTEM

This includes $150 Billion to Hospitals, and tax credits to all doctors and nurses that come out of retirement.

“We are already looking at a shortage of health care workers. Any doctors or nurse who comes out of retirement and work for the duration of the crisis should be given a $5000 tax credit,” said Meeks.

C. Tax Credit to All Companies Who Produce Masks, Ventilators, and Tests

We need to incentivize companies to switch from making non-essential consumer products to crucial PPE and medical equipment. I applaud those already takin these steps, but want to get even more businesses off the sidelines.

3. HELP BANKS HELP OTHERS

As Chairmen of the Subcommittee on Consumer Protection and Financial Institutions, Rep Meeks proposes utilizing financial institutions are a source of strength in this crisis. Under this proposal, banks must offer forbearance and work with people experiencing tough times. Congress should:

A. Pass H.R. 5322

My bill will help small community banks and minority depository institutions access capital at a time when that is desperately important. This will help banks help others.

B. Suspend all Payments on Payday Loans

Payday loans are often a blight on our financial systems in good times. Given our current economic reality, all payments on payday loans should be suspended immediately.

C. Push Regulators for an Indefinite Delay Current Expected Credit Loss Accounting (CECL) Standard

The proposed CECL standard will force financial institutions to raise extra capital and add uncertainty to the system. It must be delayed.

D. Push Regulators to Suspend all Rulemaking Unrelated to Pandemic

Both regulators and financial institutions should focus on the crisis at hand. This proposal would temporarily suspend all rulemaking that is not related to the coronavirus pandemic.

E. Amend the Federal Reserve Act to Stabilize Municipal Bond Market

Municipal bond markets are in turmoil, as state and local governments see tax revenues plunge and health care and unemployment outlays rise dramatically. The Federal Reserve Act should be amended to temporarily allow the Fed to buy long term municipal debt until this crisis has ended.

4. IMMEDIATE SMALL BUSINESS AND INDIVIDUAL FINANCIAL RELIEF

While Congress is appropriately providing funds to the Small Business Administration to provide to entities around the country, they are still in dire straits and will need more support. Rep Meeks proposal would call for:

A. Slash the SBA Interest Rate

The SBA is still charging interest around 2.75% to 3.75% on most loans. This should be zero or close to it. Although small businesses will need a lifeline given to them through loans, this proposal aims to ensure that they’re not buried in debt when they are trying to climb back.

B. Tax Deduction for Small Business Gift Card Expenditures

All gift cards bought during the crisis at local restaurants, bars, barber shops, salons, and similar entities should be made tax deductible. This will encourage individuals with resources now to get money to small business to hold onto their employees and help keep them afloat in the coming months.

C. Pass H.R. 5617 and Provide Additional Relief to Gig Economy Workers

HR 5617, introduced by Rep Meeks, ensures that taxi drivers who have received debt forgiveness will not have pay taxes on that debt relief. Many drivers are being hit hard right now because they are neither technically unemployed nor small business owners. We need to get them help. Furthermore, a bailout fund should be created for all drivers who have seen their incomes drastically decrease.

D. Pass Legislation allowing Penalty-Free Withdrawals from Retirement and Specialized Savings Accounts

This will help individuals and small business owners in need of immediate funds get cash in their hands now.

5. BROADEN AND REFORM UNEMPLOYMENT INSURANCE

This proposal works to expand, broaden, and reform unemployment insurance. Unemployed workers would be fully compensated, work search requirements would be temporarily waived, and the duration of eligibility would be expanded to 39 weeks.

6. AID AND PROTECT AIRLINE AND AIRPORT WORKERS

Airlines and airports each need liquidity in the wake of the crisis, so millions of workers can maintain their jobs. Both airlines and airports shoul each receive $50 billion federal bailout funds, a portion of which should be grants and another portion of which should be loans.

This federal relief should be contingent on the airline industry maintaining its current work force and not participating in any stock buybacks for five years following the passage of a Congressional stimulus package.

7. AID AND PROTECT HOSPITALITY WORKERS

The hotel industry should also receive federal funds, again contingent on them maintaining their current workers. Beneficiary companies should be prevented from engaging in stock repurchase agreements for five years, and should make it easier for their workers to organize.

8. MINORITY AND WOMEN INCLUSION

Past experience teaches us that under-represented minorities and women will suffer the economic consequences of the current crisis first, hardest, and take longest to recover. Black unemployment has remained double that of white Americans in both economic growth cycles and in recessions, and their net assets are a fraction that of their white peers. Minority and women business owners have less access to capital and business loans, and do so under less attractive financial terms. And minority and women leaders remain severely under-represented on boards and in the C-suite, despite ample evidence that diverse leadership yields stronger returns for investors, and more stable, resilient management. As such, any coronavirus stimulus package should include:

· Set-asides for minority and women-owned businesses;

· Inclusion of minority and women-owned asset managers, investment banks, and broker-dealers in rescue package structuring and transaction execution;

· Participation of Minority Depository Institutions and Community Development Financial Institutions in Federal Reserve Board market liquidity and loan guarantee programs, as well as Small Business Administration stimulus initiatives;

· Minimum diversity requirement for senior management and corporate boards as a pre-requisite for any company that receives government bailout funds, or accesses Fed liquidity facilities

9. COMMUNITY REINVESTMENT

Any large company or nonbank financial institution that accesses coronavirus stimulus funding, or government funded market liquidity facilities should be required to negotiate and publish low- and moderate-income community engagement commitments. This program could operate in a manner similar to the Community Reinvestment Act, a key civil-rights law that applies to banks, and requires them to reinvest in the communities where they operate. Much as the Community Reinvestment Act has been a key legislation to help redress the generational harm of redlining and dis-investment in minority and low-income communities, such a program applicable to a broader set of companies and nonbank financials could spur significant investment in under-served communities.

10. EXPEDITE A VACCINE

The coronavirus is the cause of this crisis, so there is no surer way to end the crisis than through a vaccine. Congress should require the FDA to publish coronavirus vaccine data in real time, and urge the FDA to make sure it does not impose any unnecessary hurdles on vaccine development. Congress should pass a resolution now indicating it will use all available tools to foster the development of a vaccine and end this crisis.