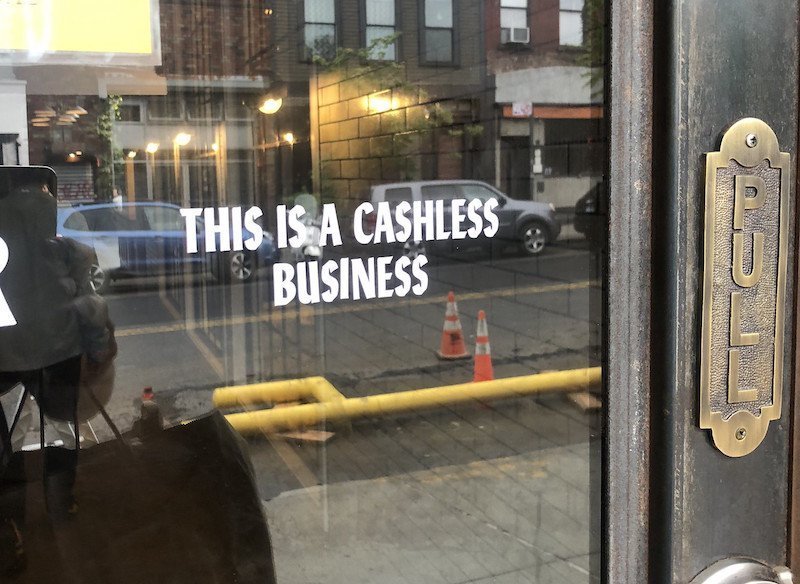

Money doesn’t talk, it yells in all caps, ‘THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE’ – that is except increasingly in the city where the ‘cashless business’ movement decided they didn’t want your greenbacks even if you really, really wanted to give Shake Shack $12 for a burger and cheese fries.

But that all changed today after City Councilmember Rafael Espinal, Jr. (D-Bushwick, Brownsville, Cypress Hills, East New York) saw his legislation, 1281-A, pass the full city council that “prohibits food and retail establishments from refusing to accept cash from consumers.” The measure also prohibits businesses from setting higher prices for consumers who use cash.

Espinal spoke with KCP before the final vote, and responded to proponents of the cashless model, who argue doing away with cash payments address safety concerns for their workers and increased efficiency for their businesses.

“The reality is that the city is the safest it’s ever been. I understand the concern but I don’t think its as strong an argument as it could have been in the 80s or early 90s. I understand the convenience that cashless brings to businesses but at the same time they are inadvertently keeping out a population of folks who are underbanked or unbanked, and we have to be very mindful that we are not creating segregation within our own city because of convenience,” said Espinal.

“We have to make sure that all New Yorkers have access to every single business that the city has to offer. That’s why I think this is a very important bill,” he added.

Introduced in 2018 with Espinal’s fellow primary sponsor Ritchie Torres ( D-Bronx), Int 1281-A came in response to the growing trend of cashless retail businesses, many of them restaurants and coffee shops. Some Shake Shack locations were early adapters of no-cash sales, joined by Dos Torros, Sweetgreen and others.

City Council member Mark Gjonaj ( D-Bronx) expressed frustration at being unable to use cash during a recent visit to a coffee shop, knowing that many of his constituents could be shut out by stores refusing to accept legal tender.

“I am in support of any law that gives New Yorkers more options and access as consumers,” said Gjonaj.

Critics of the cashless trend have pointed to the incentives offered by credit card companies to opt for that practice. These companies were offering thousands in business development funding to retail businesses going cashless, with the understanding that their processing fees, typically around 2%, would increase substantially.

Opponents also claimed that cashless businesses discriminate by class, violate privacy rights and have a disparate impact on consumers belonging to disadvantaged racial groups and ethnicities. Customers without a bank account or the ‘underbanked’ (Those with bank accounts who depend on cash or other means) were in effect excluded as customers so that the practice was discriminatory in effect if not by intent.

Businesses that opted to go cashless argued that as private businesses they have a right to decide the way they collect payment, but emphasized increased employee safety, the time employees must devote to collecting and managing cash, and decreased labor costs for an industry that traditionally operates on small profit margins.

Anecdotally, businesses reported increased volume due to streamlined sales. But Espinal and Torres’ bill passed on Tuesday with broad support in the council, who saw inclusivity as essential beyond whatever gains in convenience and efficiency that businesses found with the cashless model.