Attorney’s for the city stated in State Supreme Court that they are concerned if they lose upcoming litigations over a controversial city housing program, it may result in tens of millions of dollars of properties being returned to their owners.

The cases involve at least two and maybe more of the 63 properties the city’s Department of Housing Preservation and Development’s (HPD) seized in 2017 with no equity given from mainly black and brown property owners and given to connected non-profit and for-profit developers under the ruse of keeping the buildings affordable.

All the cases involve HPD’s Third Party Transfer program as chronicled in an ongoing KCP series.

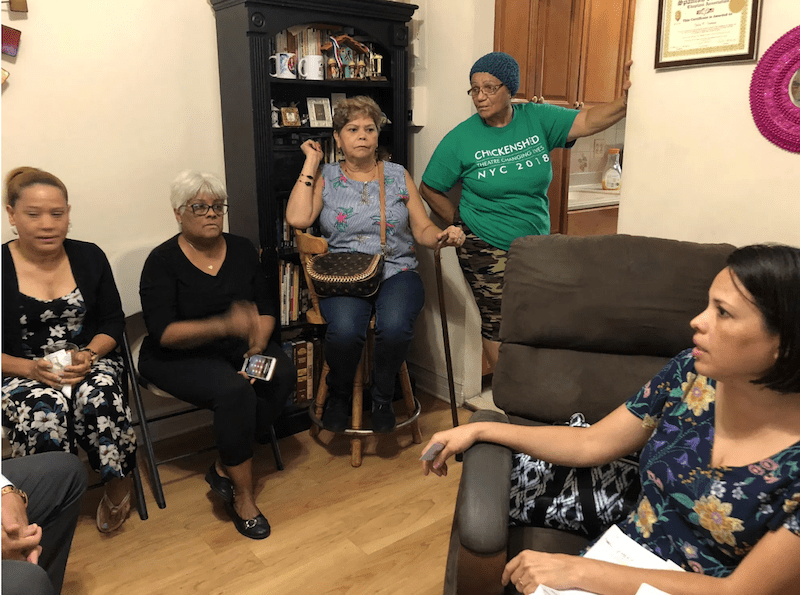

In one case, a group of working class Latino shareholders at 19 Kingsland Avenue in Williamsburg, are currently in a court battle to regain ownership of their property. The building was an HDFC or Housing Development Fund Corporation (HDFC) co-op up until this year, a special ownership program designed when property values in the city were at all-time lows to conserve low-income housing across the city.

The six tenant families charge the city of stealing their property under false pretenses including categorizing the building as “distressed” and not giving shareholders sufficient notification of an in rem foreclosure process on the property.

The city has asked for repeated continuances in the case so far, and is headed for court later this month. According to Angelyn Johnson, the lawyer for the tenants, the city is asking for more time to file “opposition papers” in response to her motion to vacate the foreclosure judgement, because according to the filings it was “improper.”

“But what’s really damaging is that you give this six family building, in horrible condition, to low-income people, who then have to spend their money to get a new boiler, to get a new roof, to get new windows, just to live in the building. And now that they’ve done all that work, they enter into an in rem foreclosure process because of property arrears and water charges,” said Johnson.

“But how do you really expect low to moderate income people, because that is what a HDFC is right, to fix up their building, and to pay real estate taxes and to do sewer service on top of maintaining the building. And now the city wants to make them rent-stabilized tenants? You’ve got to be kidding me!” added Johnson

A motion to vacate judgment refers to a request that is filed before the court that entered the judgment to dismiss the judgment.

In fact, Yudy Ventura, 52, president of the co-op board, and her neighbors of almost 20 years contend, that they never received notice that their property was ever in foreclosure until last September, when they came home to a flier under the door that alerted them to the City’s TPT Program.

The building now has a market assessment of about $2.4 million in a developing neighborhood that has a new market-rate five-story multi-building complex next door and a high-end grocery store on the same block. The shareholders took ownership of the home back in the 80’s when the neighborhood was full of Latino families and native New Yorkers.

City attorneys have also asked for a continuance in regard to the 19-unit building at 25 MacDonough Street, which the city has taken under the TPT program with no compensation to the black family which owned the property for 50 years.

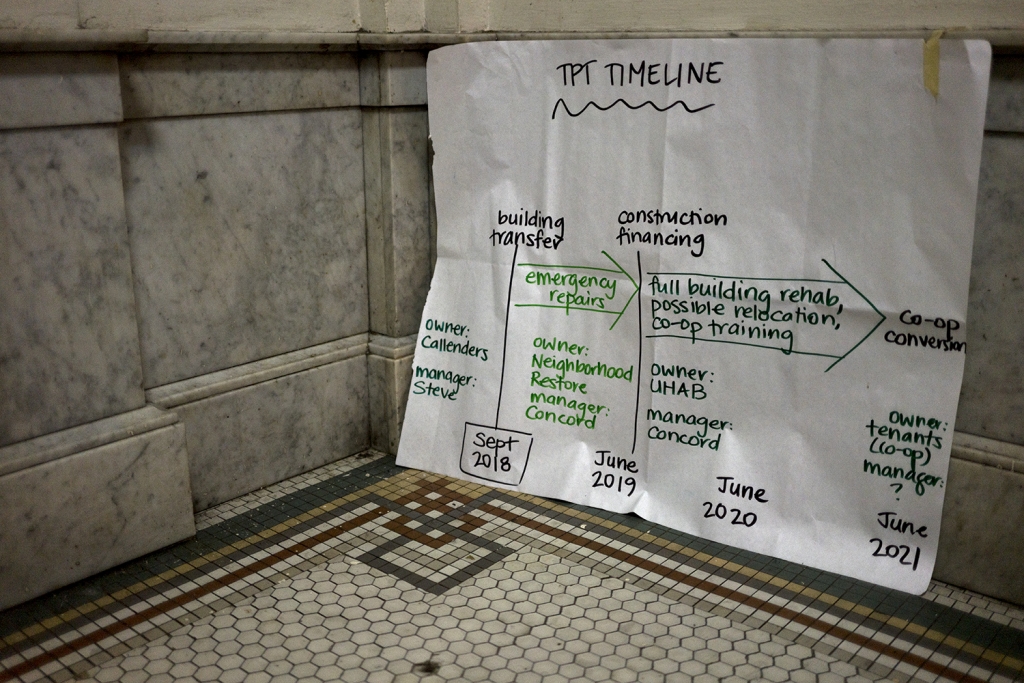

In this case, the city gave the property to the Wall Street-based non-profit Urban Homesteading Assistance Board (UHAB) for back property taxes and water bills totaling about $120,000, and after labeling it a “distressed property.” It is currently worth about $3.2 million and sits on a choice block near two subway stations and a stone’s throw from Fulton Street – Bed-Stuy’s main commercial thoroughfare.

According to both Lamarr Jones, who is part of the family who owned the building and their attorney, Amy Marion, city attorneys returned to court after filing motions admitting the property was not distressed, but were able to take it citing a law that if another property on the tax block is distressed the city has the right to foreclose on other properties on the block that owed back taxes.

Both Jones and Marion said city attorneys also argued before State Supreme Court Judge Mark Partnow that they had concerns if they lose the case it could mean that all 63 properties worth tens of millions of dollars could be returned to their owners – many of whom are black and brown and own the properties outright with no mortgage.

Jones and Marion also told KCP that Partnow expressed concerns with how the City’s Department of Finance could take money for back taxes and then freeze the account of the property owner. In all the cases, that KCP has been covering, property owners have paid some or all of their back taxes with the money taking months to get credited to their property taxes.

Partnow continued the case to Jan. 9, and ordered DOF officials to come to court on that day to explain how this property was chosen for foreclosure and why was their account frozen even though they had made tax payments.

A win in either case could mark a disastrous halt to the housing program as many of the other buildings in the program could be forced into review. Local electeds and community leaders have already asked for a moratorium on the program including calling for a full-scale forensic audit and investigation on the federal, state, and city levels into the issue of deed fraud in the borough of Brooklyn, which includes TPT.

Under the TPT program, the new “sponsors” of the building receive the building for $1 and $8,750 per unit, clear of any mortgage or property arrears in exchange for their so-called service in “renovating the building.”

These sponsor/owners also get access to public financing to renovate the building at one percent and in some cases no-percent interest.