Most of New York City’s Congressional delegation Tuesday lauded the House passage of the partisan $3.5 trillion Build Back Better Act resolution, a blueprint for massive social services spending to lower healthcare, childcare and education costs while raising taxes on the wealthy.

The party-line 220-212 vote was passed amid much hand-wringing after 10 moderate House Democrats threatened to vote against it because they wanted the $1 trillion ‘brick-and-mortar’ bipartisan infrastructure bill dealing with items such as our crumbling roads and bridges voted on first.

After through-the-night negotiations, House Speaker Nancy Pelosi (D-CA) succeeded in bringing the 10 moderates on board after agreeing to vote by Sept. 27 on a $1 trillion Senate-passed infrastructure bill.

Pelosi has long said she wants both bills on the same track. Passage of the Build Back Better Act now allows the House to form committees and work with the Senate to build out exactly how the $3.5 trillion will be spent and paid for.

If successful, the measure can be passed without any Republican support as part of a legislative process known as budget reconciliation that can only be applied to legislation that affects spending, revenue or deficits.

“Today, the House took an important step towards delivering on House Democrats’ historic agenda. This budget is a major investment in our families, seniors, workers, and children. Expanding Medicare will provide vision, dental and hearing coverage for millions of seniors while families will now have paid leave when they need it,” said U.S. Rep. Jerry Nadler (D-Manhattan/Brooklyn).

“The Build Back Better Plan extends the Child Tax Credit for working families, delivering one of the largest tax cuts for American families ever. And along with creating millions of good jobs, the budget blueprint also addresses the climate crisis by lowering carbon emissions by 50 percent by 2030. This bold, progressive budget will have a positive impact on every single American family and I look forward to passing the final product in the coming weeks,” he added.

U.S. Rep. Hakeem Jeffries (D-Brooklyn/Queens) said the Build Back Better is essential because prior to the pandemic, about half of the American people reported that they couldn’t afford a sudden, unexpected $400 expense, which is unacceptable.

“We are not going back to that. We’re going to Build Back Better. Part of that agenda involves the bipartisan infrastructure bill, which we’re going to advance, and part of that is going to be the Build Back Better Act that involves jobs and tax cuts and lower expenses for families, children and everyday Americans. We’re committed to getting that done,” Jeffries said.

U.S. Rep. Yvette Clarke (D-Brooklyn) called the Build Back Better budget resolution a win for the American people.

“[It is] putting us on the path toward enacting popular and urgent policy change for our communities, including universal child care, paid leave, aggressive climate action, Medicare expansion, affordable housing, and a roadmap to citizenship. My position remains unchanged: we will work to first pass the Build Back Better reconciliation bill so we can deliver this once-in-a-generation, popular, and urgently needed investments to poor and working families, and then pass the infrastructure bill to invest in our roads, bridges, and waterways,” said Clarke.

One Congressional source told PoliticsNY that the $3.5 trillion is very likely to be pared down considerably, particularly to pass the Senate, which has a one-vote Democratic majority. It also will have some opposition from moderate House lawmakers on some of the details.

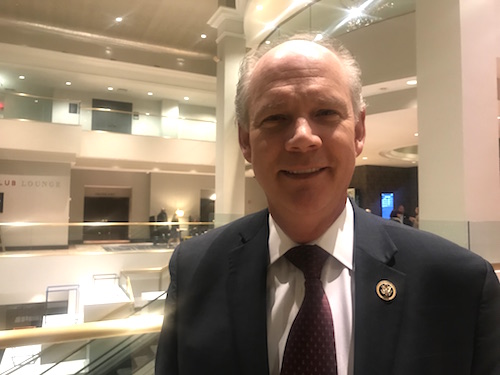

Moderate U.S. Rep. Tom Suozzi (D-Queens/Long Island) – not one of the 10 House members that opposed the resolution – noted the Build Back Better bill will also include changes to the tax code.

Suozzi said he has no problem on which infrastructure bill is voted on first but his line in the sand on the Build Back Better Bill is the restoration of the State and Local Tax (SALT) Deduction, which former President Donald Trump rescinded. SALT saves thousands of dollars for homeowners in his district and around the country in highly taxed states.

“I will not vote for the reconciliation bill which involves the changes in the tax code, unless it involves the restoration of the SALT deduction. No SALT, no deal,” Suozzi said.