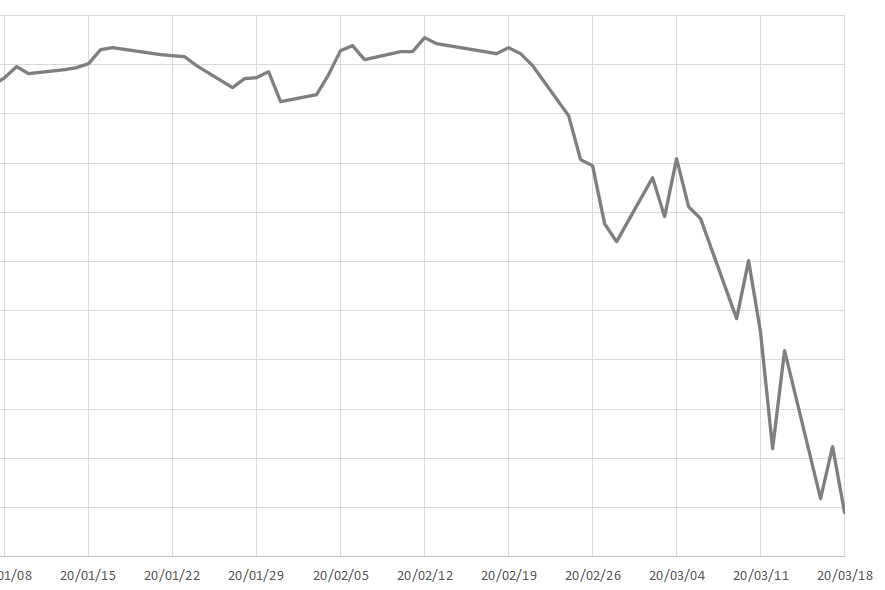

Since February, the global COVID-19 pandemic has wreaked havoc on the economy. The omnipresent fear of infection has spooked consumers and investors alike, causing business to grind to a halt. On Mar. 18, the Dow Jones closed below 20,000 points for the first time since President Donald Trump (R) took office – provoking fears that the incoming recession could rival or even surpass the housing bubble burst of 2008.

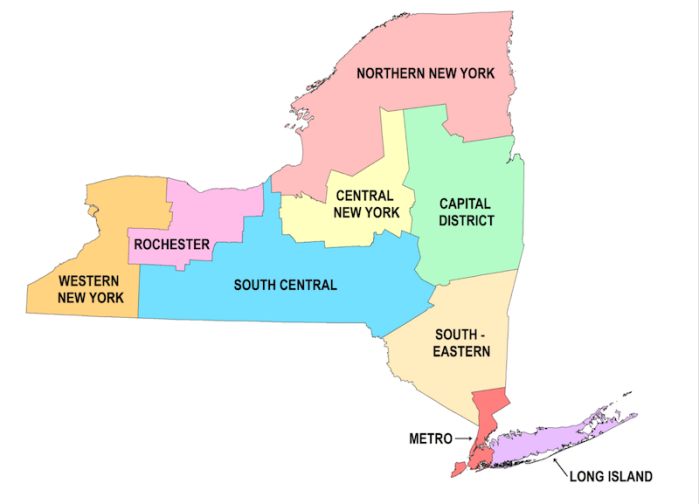

In the face of this turn of events, NYCP has reached out to several New York primary challengers to ask about their plans to address the bear market: Lindsey Boylan, who is challenging U.S. Rep. Jerrold Nadler (D-Manhattan, Brooklyn) for the 10th congressional district; Suraj Patel, who is challenging U.S. Rep. Carolyn Maloney (D-Manhattan, Brooklyn, Queens) for the 12th congressional district; and Grace Lee, who is challenging Assemblymember Yuh-Line Niou (D-Chinatown, Financial District) for the 65th assembly district.

Lindsey Boylan

Boylan has developed what she calls a “dual approach” to the problem, utilizing both short-term and long-term economic relief measures. Her plan would begin with immediate aid to New York’s working class, in the form of $2000 cash payments and expanded unemployment benefits. For long-term relief, Boylan would develop business continuity grants under the Small Business Administration (SBA) for businesses in low-income communities.

“In times of crisis, you need a dual approach. One to ensure health and safety and another to deal with the economic aftermath which impacts people for years,” said Boylan. “When a crisis hits, our economy comes to a halt. Far too many people don’t have access to work-sponsored benefits like healthcare, work from home, and paid family leave. How we show leadership to support those that will go without a paycheck and benefits in the short term will determine how our communities recover once the crisis is over.”

Suraj Patel

Patel’s current plan focuses on direct, immediate relief; it includes mandatory paid sick leave, government subsidization for the wages of furloughed employees, and a moratorium on sales tax collection. Several of these measures have also been championed by Rep. Maloney – particularly paid sick leave, a stipulation in the recently passed Families First Coronavirus Response Act.

Patel has argued that, given the current state of our economy, the federal government is now in a prime position to borrow money for the stimulus.

“Interest rates are near zero, inflation is nowhere to be seen, and U.S. Treasury yields are currently near zero,” Patel wrote in an article for Medium. “This means it has never been a better time for the U.S. to borrow. Fiscal policy is optimal given the current macroeconomic outlook. In addition to an accelerated fiscal response to provide immediate relief from the COVID-19 Pandemic, Congress needs to carefully construct a large fiscal stimulus to put the U.S. on a permanently increased growth path.”

Grace Lee

Lee, a small business owner, has produced a plan that focuses on providing aid for small businesses and working families. Her plan includes the expansion of Earned Income Tax Credit (EITC), a refundable tax credit for low and mid-income families. The retroacive expansion of the EITC for New York’s 2019 tax year would put more money in the pockets of those families, facilitating an economic stimulus.

“While the emergency shutdown of our state’s economy is necessary to stave off this pandemic, within the next two weeks, we must enact stimulus measures like those first adopted during the Great Recession of 2008 to provide a necessary shock to the system,” said Lee. “This is the best way to protect our small businesses, save our working families and get New York State working again.”

![City Hall [Credit: "Aude" of Wikimedia Commons]](https://politicsny.com/wp-content/uploads/2021/02/Nyc_city_hall_july2006b-e1589477471165.jpg?quality=51&w=700)