When it comes to hot retail commercials corridors Bedford-Stuyvesant, Park Slope, Cobble Hill and the Fulton Mall are all doing well while Brownsville and Coney Island is gasping for air – but the bottom line remains that storefront vacancies are up, according to a city Department of City Planning report issued this week.

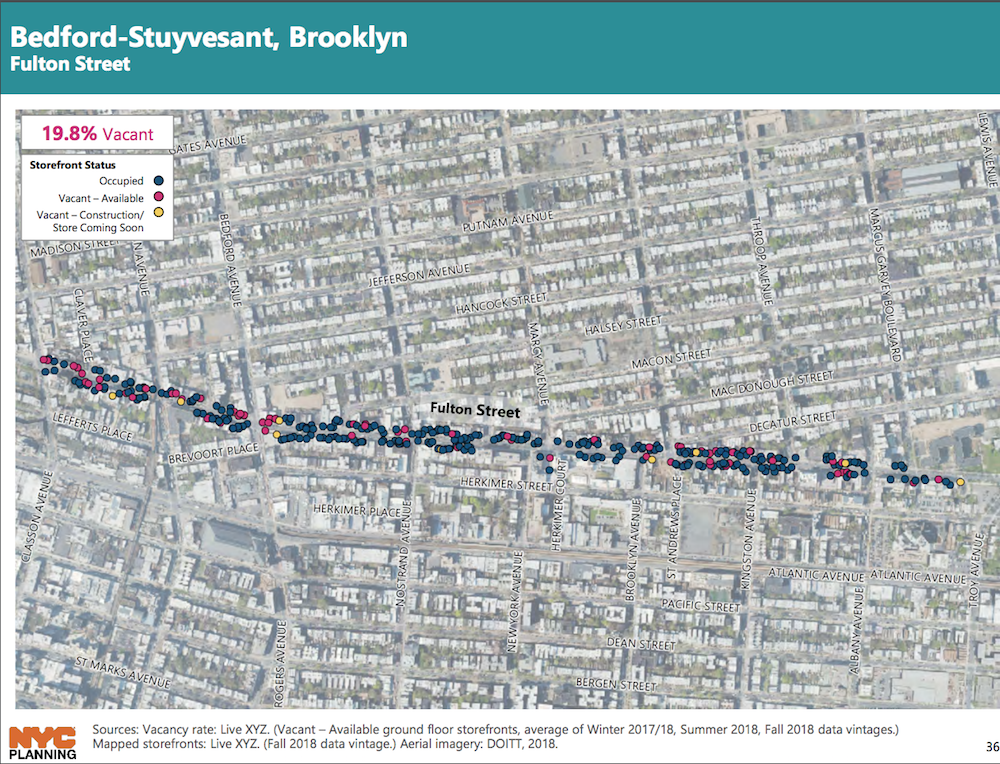

The lowest vacancy rate in these neighborhoods – the Fulton Mall from Flatbush Avenue to Boerum Place – stands at 8.2%. The highest vacancy rate is Fulton Street in Bedford-Stuyvesant from Classon Avenue to Troy Avenue, which stands 19.8%.

The report, “Assessing Storefront Vacancy in NYC,” offering a detailed exploration of recent retail trends and storefront vacancies in New York City in the context of shifting technology, economic forces, and consumer preferences.

The data-driven white paper looks at 24 neighborhoods across the city including the aforementioned Brooklyn neighborhoods in an effort to develop a data-driven understanding of retail and storefront uses and how they may be changing.

The data-driven white paper looks at 24 neighborhoods across the city including the aforementioned Brooklyn neighborhoods in an effort to develop a data-driven understanding of retail and storefront uses and how they may be changing.

“In an ever-changing city where neighborhood shopping is an important facet of urban life, it’s crucial that we put as much reliable data as possible into the hands of business owners, residents, policymakers and elected officials. DCP’s research shows that the reasons for storefront vacancies are complex and varied and that solutions must be nuanced and targeted – or we may do more harm than good. And, encouragingly, our research also reveals that many community shopping districts are thriving,” said DCP Director Marisa Lago.

The report defines hot corridors as ones where rents have increased notably in recent years, and where some building owners kept spaces vacant while seeking high rents.

In many cases in these corridors, landlords had promised certain rent levels and a “credit tenant” to their lenders in order to secure favorable loan terms while others did not hold out given ongoing costs that must be covered by rents, indicating market adjustments may be occurring.

This indicates high asking rents are proving unattainable in these corridors and a large supply of vacant property has increased competition for tenants. Many owners are now settling for lower rents and providing other concessions, according to the report.

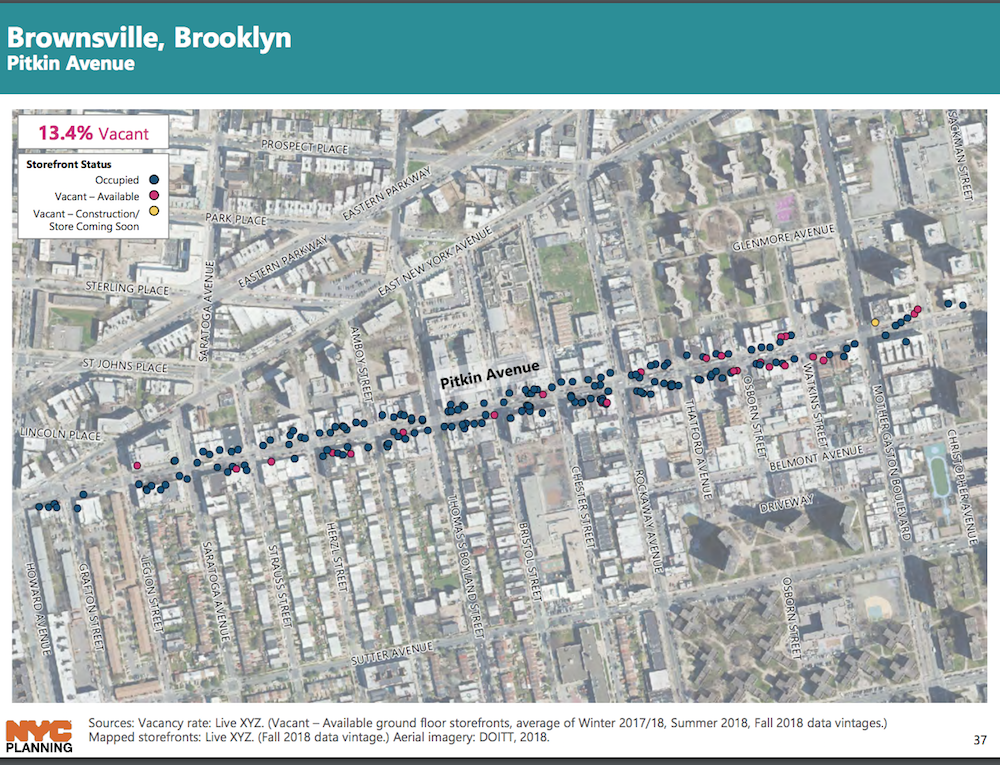

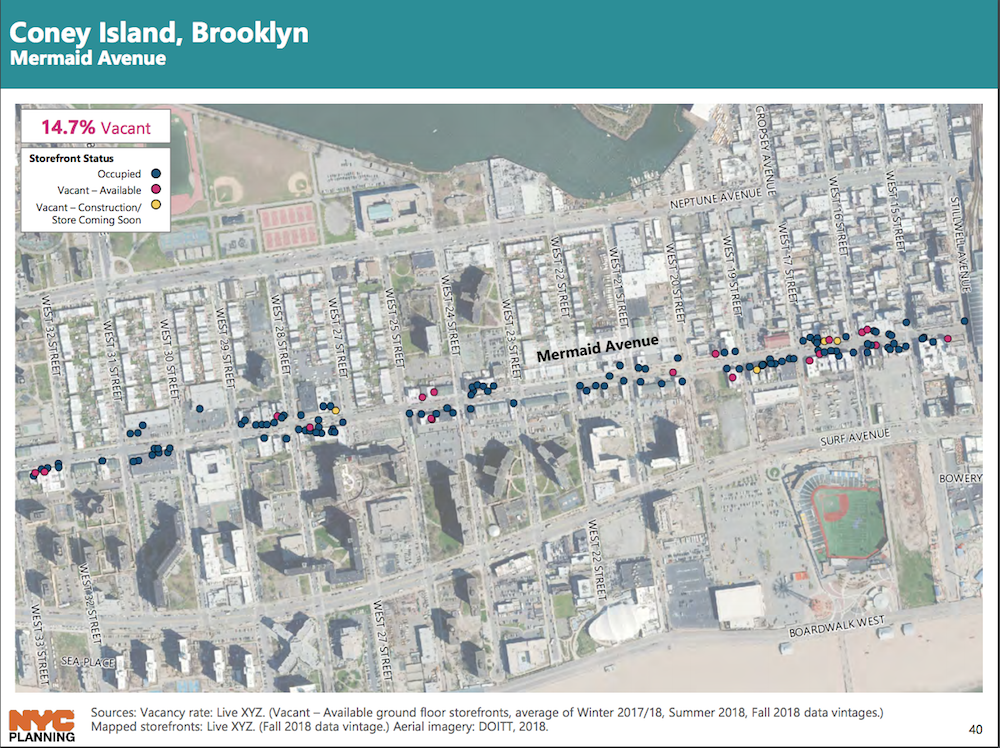

Conversely, the report defined underperforming corridors characterized by long-term historic disinvestment where storefronts may be difficult to tenants due to poor conditions or negative perceptions of the neighborhood.

These corridors have greater difficulty attracting spending, with a lack of anchor tenants to draw in shoppers and nearby residents that tend to drive to malls in other neighborhoods.

The study did conclude that while several neighborhoods are challenged by high vacancy rates the condition is not universal. The rise of e-commerce, demographic shifts, real estate market trends, local building stock, and other conditions contribute and vary from street to street. There is no single dominant trend in retail in New York City.

For instance, vacancy rates in Brownsville and SoHo/NoHo were about equal: 13.4% and 13.8% respectively, a 5-10% rate is generally considered to be healthy by the industry, yet high vacancy levels in these two areas are likely due to very different causes. Brownsville is characterized by a weaker retail market and long term disinvestment, in contrast to SoHo/NoHo, where rising rents contributed to higher vacancy.

For instance, vacancy rates in Brownsville and SoHo/NoHo were about equal: 13.4% and 13.8% respectively, a 5-10% rate is generally considered to be healthy by the industry, yet high vacancy levels in these two areas are likely due to very different causes. Brownsville is characterized by a weaker retail market and long term disinvestment, in contrast to SoHo/NoHo, where rising rents contributed to higher vacancy.

The DCP posits that neighborhood shopping corridors are essential to urban life, they offer goods and services for residents and workers, a vibrant and walk-able street environment, and entrepreneurship opportunities for small businesses.

Retailers who have negative perceptions of a neighborhood may choose not to locate there, potentially leading to a lack of services for which there is strong demand. For example, Brownsville residents have long called for a sit-down restaurant. For the first time in decades, one finally opened in 2017: the Brownsville Community Culinary Center.

Additionally, lack of access to capital makes it difficult for some storefront owners to make improvements to their spaces, some of which are aging and in disrepair.

Additionally, lack of access to capital makes it difficult for some storefront owners to make improvements to their spaces, some of which are aging and in disrepair.

“The results of the study suggest that any public interventions to address vacancy should be carefully considered and nuanced. They should recognize the diversity of New York City’s neighborhoods, support the needs of businesses and communities, and provide adequate flexibility for corridors to evolve as conditions change,” the report concludes.