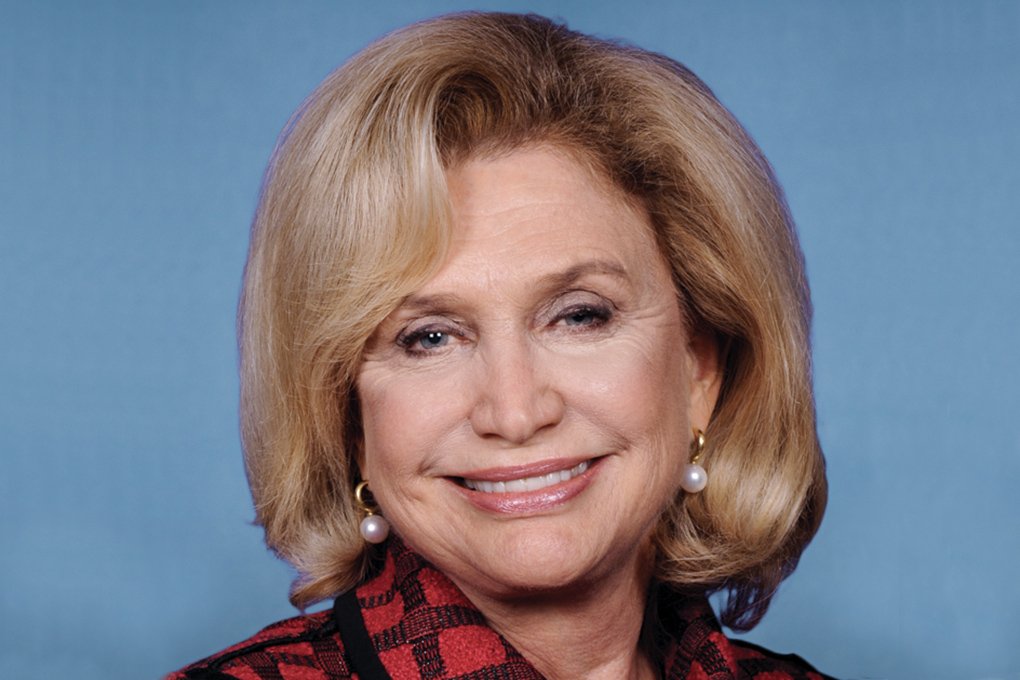

Representative Carolyn Maloney (D-Upper East Side) released her Views and Estimates of the federal budget yesterday, offering a harsh assessment of the Trump administration’s economic record.

Maloney’s assessment came on the heels of the release of the Trump administration’s Fiscal Year 2020 budget proposal, which called for major cuts to domestic programs like Medicare and Medicaid and increased funding for border security. The proposal, said Maloney, will damage the country severely if it becomes a reality.

“The president’s budget is an economic ticking time bomb,” Maloney said in a statement. “Economic growth depends on making smart investments and smart projections about the future. This budget does neither. Instead, the president’s budget includes deep cuts to critical domestic investments, including Medicare, Medicaid, education and research, while at the same time making wildly optimistic projections about future growth. If this budget were ever to become law, it will knock our country’s economy off track, possibly into recession, and cause severe pain for families all across the nation.”

In a letter addressed to Representative John Yarmuth (D-KY), who is also the Chairman of the Committee on the Budget, Maloney analyzes the impact of Trump’s fiscal policies, particularly the Tax Cuts and Jobs Act (TCJA). In her estimate, although the tax cuts seem to have boosted the economy in the short run, the benefits are meager and unlikely to last much longer.

“Since enactment of the TCJA, the economy experienced a small temporary

stimulus, which already appears to be waning,” wrote Maloney. “The promised investment boom – which Republicans claimed would fuel long-term growth – has failed to materialize. One common measure of expected investment, new orders for nondefense capital goods excluding aircraft, fell

in four of the last five months of 2018. A survey of business economists found that 84 percent reported no change to their firms’ hiring or investment plans because of the tax cuts.”

Furthermore, the document points out that the TCJA enacted a $1.9 trillion cap on tax deductions in order to compensate for the cost – which will actually result in higher taxes for middle-class families.

“The failure of the tax cuts to drive private sector investment and the added pressure the law puts on state and local investment means that the Budget Committee should not expect robust tax cut driven growth in the near future,” wrote Maloney.

The last page of the letter implores Mr. Yarmuth to start investing in education, infrastructure and workers’ compensation in order to foster economic growth in the long run – and emphasizes that now is the time to do it, while the economy is still strong.

“Low interest rates and a strong labor market mean that now is the time for Congress to think about the future and make investments that address structural concerns and grow the economy in the long run,” wrote Maloney. “This includes investing in productivity-boosting policies like upgrading the nation’s infrastructure, making education more accessible and affordable, and boosting federal research and development efforts. It also includes policies that enable all Americans to join the labor force, such as in expanding access to affordable child care that enables parents to succeed in the workforce. Addressing long-term economic threats, such as climate change and rising income and wealth inequality, should be priorities for the Budget Committee as well.”