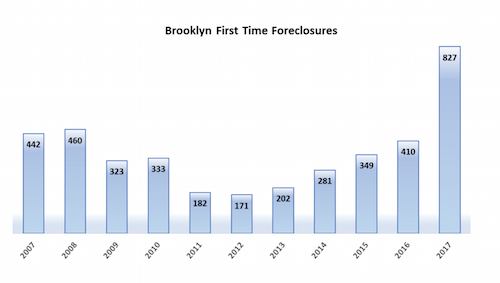

With Canarsie and East New York leading the way, foreclosures in Brooklyn doubled last year and were at their highest levels in over a decade, according to a report the real estste website PropertyShark released yesterday.

The reports found that 827 homes were scheduled to be auctioned in Brooklyn during 2017, while there were 410 first time foreclosures in 2016.

The previous record dates from 2008 when foreclosure cases peaked across the city and Brooklyn had 460 homes scheduled.

The previous record dates from 2008 when foreclosure cases peaked across the city and Brooklyn had 460 homes scheduled.

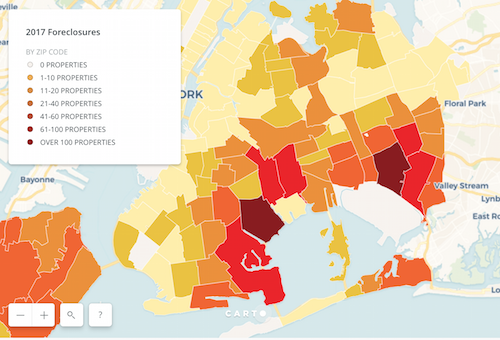

The highest concentration of foreclosed homes is located in the eastern part of the borough, with zip code 11236 in Canarsie logging 113 new cases. Neighboring zip codes 11208 (East New York) and 11234 (Canarsie) follow with 94 and 86 cases, respectively.

“We’ve had this issue for a very long time and it’s a serious problem,” said City Councilman Alan Maisel (D-Canarsie, Flatlands, Bergen Beach), adding there are a number of organizations such as the Neighborhood Housing Services on Avenue L that are trying to stem the tide of foreclosures.

“A lot of people bought without a lot of resources and then something happens that collapses their plans. For certain there are a lot of real estate brokers that arranged for people to get houses that they just couldn’t afford,” he added.

Maisel said many constituents come to his office with these problems and he tries to help them all. Last year, two sisters bought a house, and then one of the sisters lost her job and there goes their ability to pay for the house, said Maisel.

Maisel said another problem is there are many two-family houses in the district, and people buy a house thinking they can rent out the other apartment and then the tenants scam them by paying for a month or two and then stop paying rent.

“They [the homeowner] goes to court, but it takes months to get the tenants removed and people lose their house. Studies have shown the financial condition of landlords [in two-and three-family homes] are not marginally better off than their tenants,” said Maisel. “You can’t treat a two-family homeowner like they are LeFrak.”

Maisel said another issue is a number of homeowners suffered severe damage from Superstorm Sandy and were not made whole through government repair funding, leaving them unable to rent out second apartments and/or having to make repairs out of pocket.

There are a lot of people who come into the office that make around $50,000 and are paying on a $500,000 mortgage making them house poor and yet they don’t want to sell their house because they see it as their investment and retirement, said Maisel.

Maisel said while he is not surprised that foreclosures are up in the neighborhood, there could be more coming as last year there were between 800-900 homeowners that were earmarked for liens against their property for failing to pay water and property taxes.

“Every year my office works with the Department of Finance to put some of these people on a payment plan, but some fall into foreclosure,” Maisel said.