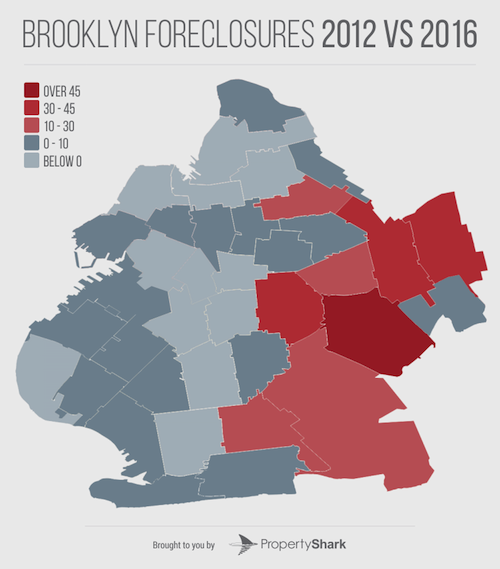

A recent report by PropertyShark showed that the Eastern half of Brooklyn was the source of the borough’s high foreclosure rates within the past five years while Western Brooklyn saw very little foreclosure activity.

The article outlining the results of the research, written by Andra Rus, states that the reports “exposes Brooklyn as a divided borough.” The results of the report were calculated based on residential property sales closed between 2012 and 2016.

One of the primary takeaways the report outlined was the fact that five zip codes accounted for nearly half of all new foreclosure cases. This included Canarsie (11236) which accounted for 52 cases total and East NY (11207) which accounted for 47. The other zip codes on the list were in Flatlands and East Flatbush. PropertyShark attributes the high number of foreclosures in these areas to the fact that they have the largest number of property owners with an annual income of less than $50,000.

One of the primary takeaways the report outlined was the fact that five zip codes accounted for nearly half of all new foreclosure cases. This included Canarsie (11236) which accounted for 52 cases total and East NY (11207) which accounted for 47. The other zip codes on the list were in Flatlands and East Flatbush. PropertyShark attributes the high number of foreclosures in these areas to the fact that they have the largest number of property owners with an annual income of less than $50,000.

An interactive map showing the pre-foreclosure rates and price changes can be found at propertyshark.com.

A $700,000 price discrepancy between the most expensive and the least expensive areas of Brooklyn. This has increased since 2012, when the price gap was $500,000.

The report also showed that the median price increased the most in Bushwick, Bed-Stuy and Prospect-Lefferts Gardens. The rate increased by over 100% in all three neighborhoods. The data for this part of the report was extracted from the US Census Bureau in 2015. Said data showed that this shift is due to the borough’s wealthiest renters moving to the Northwest area of Brooklyn making the report attribute the increasing prices of the affected neighborhoods to the increasing rate of wealthy renters in Brooklyn and gentrification. The report showed that renter households earning over $150,000 annually increased 324% since 2011.

The residential properties included in the stats were single-family homes, condos and co-ops.

PropertyShark is a property research tool founded in 2003 by real estate investor Matthew Haines. It offers property reports for both the commercial and residential sectors to determine information such as when the property was developed, who owns it, sales history, property value estimates, information about current zoning and air rights for real estate agents, investors, appraisers, developers, insurance agents, acquisition professionals, mortgage brokers, property managers and home buyers.