EDITOR’S NOTE: As part of an on-going series, KCP is asking candidates running for state office in the upcoming Sept. 13 primary about issues that matter and that are being debated in Albany.

In the 44th Assembly District, there are four candidates running for the seat left vacant by the recent retirement of longtime Assemblyman James Brennan. They are Robert “Bobby” Carroll, Troy Odendhal and Robert Curry-Smithson on the Democratic Party side and Glenn Nocera is running unopposed on the Republican side. Additionally, Carroll has the Working Families Party line on the ballot and Nocera has the Conservative Party line on the ballot.

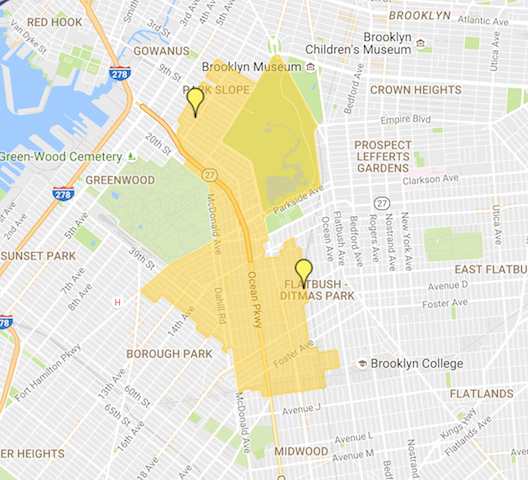

The district includes the neighborhoods of Park Slope, Windsor Terrace, Greenwood Heights, Kensington, Ditmas Park and part of Borough Park. At one time the district had a large concentration of Irish and Italian Catholic working-class families. While there remains some of this population, particularly in Windsor Terrace, the district now also includes a large population of Muslims from Bangladesh and Pakistan, Orthodox Jews and new immigrants from around the world.

KCP’s question to the candidates is as follows:

The New York State legislature continues to debate on whether to give a tax credit to parents that choose to send their kids to private or religious schools instead of public schools. The bill would give a tax credit of up to $500 per student who attends a private school to a family with an income of up to $60,000 annually. Proponents argue that the cost for parents to send their kids to private school is enormous, but they should have a choice, particularly if their children’s local public school is underperforming. Opponents say this bill will take valuable money resources away from public schools, doesn’t separate church and state and that it undermines charitable organizations who offer tax credits.

As a candidate for state assembly, what are your thoughts about the proposal to give tax credits to families who have children in private schools?

Troy Odendhal: “Local and state government can be instrumental in creating sound educational options for parents. However, I also believe the Parental Choice in Education Act lauded by Governor Cuomo is just another taxpayer funded corporate giveaway couched as a tax credit for families. It’s another ploy to provide corporate interests access to limited tax resources greatly needed for education.

“First, the bulk of the Governor’s proposal – supported by the Senate’s Education Investment Tax Credit bill – is geared towards tax deductions for corporations that donate to private education entities. It allows corporations or individuals to receive up to a 90% tax credit on qualified educational donations up to $1 million, plus any amount carried over from a prior year. As far as helping parents pay for their children’s education, only families making less than $60,000 a year will receive a $500 credit per child towards the cost of private school. Families would receive that credit as a refund even if their tax liability was zero. Secondly this bill, as it is currently proposed, would do little to benefit families in Brooklyn’s 44th District. Proponents of the bill cite “underperforming” schools, as a catalyst for parents seeking private school options.

“Fortunately in our district, we do not have underperforming schools however we do have overcrowded schools. This bill does nothing to address the larger issues facing many New York parents, such as overcrowding, infrastructure needs and teacher-student ratios. These are the issues that deserve more attention than a tax credit for educational donations which have the potential to benefit a small percentage of students and schools”

Rob Curry-Smithson: “We all pay taxes for the public good. This means my tax dollars fund schools, roads, fire departments and many more things. Some people don’t have cars, they still pay for roads. Some people don’t own homes that could burn down, yet they still pay for the fire department. Some people don’t have children, they still pay for public schools. Private school is a private choice, and public funds shouldn’t be diverted to them. This sort of tax credit would mean a tax hike for parents who send their kids to public school. In addition, our constitution requires a separation of church and state. Tax credits for religious schools is a form of payment to religious institutions and violates the principle of separation of church and state.”

Glenn Nocera: “Parents should have a choice on what type of education their child should have be it religious or public school or private.

“On this issue I believe that the Democrats have the wrong stance because we have choice when it comes to abortion but we don’t have a choice when it comes to educating the child. A lot of our public schools are failing especially in the minority communities. I believe that every parent that they should have a choice when it comes to educating their child so they could have the best education that could be afforded to them. We cannot afford keeping any child behind because a lot of these schools have become breeding grounds for gang activity, which is a hostile environment for learning. The public school system has failed all parents when it comes to properly educating our children in those schools.”

Carroll was approached several times to give his view on this vital issue that affects thousands of constituents in his district, but did not respond by post time. He did, however, post his view in the comments section.