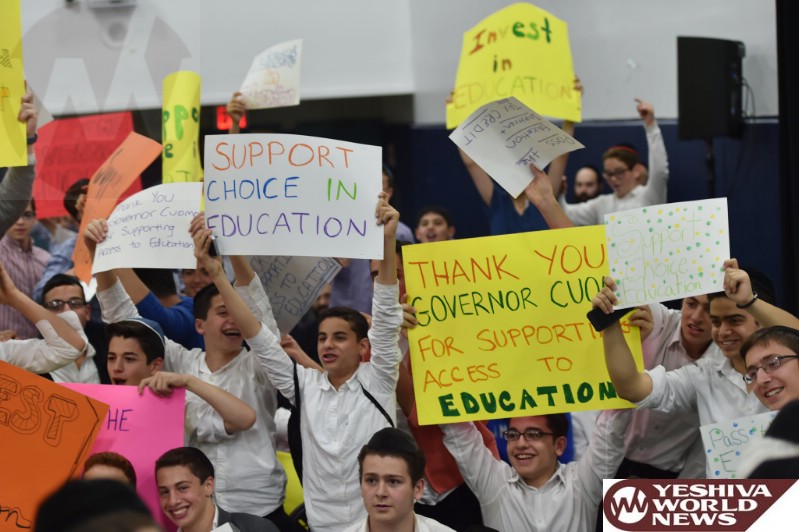

Despite its popularity in some circles, Gov. Cuomo‘s education tax credit proposal for parents and donors of nonpublic schools might have a difficult time getting traction in the state assembly.

The proposal, dubbed Parental Choice in Education Act and released last week, gives $150 million in tax credits to families and supporters of non-public schools including $70 million to families with incomes below $60,000 per year, who would qualify for up to $500 per student for tuition expenses to nonpublic schools.

Additionally, the measure would give $50 million in tax credits in which individuals and businesses can receive a tax credit for up to 75 percent of their donations made to not-for-profit organizations that award scholarships to students in grades P-12.

It is this second provision that has a long list of opponents, led by the New York State Unified Teachers (NYSUT) and its powerful allies, who call the tax credit a slight-of-hand giveaway to wealthy donors to non-public schools. Additionally, they say the measure, in effect, supports non-public schools with taxpayer money.

“This tax credit is just another scheme to reward billionaires. It gives them the power to send money to their favorite private schools, and takes a big chunk out of their tax bill,” said Michael Mulgrew, President of the United Federation of Teachers. “At the same time, it drains money from public schools. Supporters can use all the smoke and mirrors that they want, but in the end this is scam that will hurt public school students.”

In a fairly rare untied front, the New York Coalition of Community Charter Schools also opposes the tax credit.

“We support choice in public education and it’s written on all our press releases that charter schools are public schools,” said Steve Zimmerman, co-chair of the New York Coalition of Community Charter Schools. “As it’s (Parental Choice in Education Act) currently written, its thrust seems to be in a direction away from public education. We cant support it as its currently exists.”

But Borough Park Assemblyman Dov Hikind along with many ultra-Orthodox Jewish organizations and churches support the education credit..

“Calling education tax credits a gift to the rich is so dishonest that it’s hard to believe anyone with the facts could even say that,” said Hikind. “Rich people don’t save a solitary dime in their pockets with the passage of these tax credits. It would simply mean they would be afforded an opportunity to see their money go towards the scholarships of less fortunate, lower-income families than directly to the state. And the people who are eligible for these scholarships are hardly those whose income anyone would characterize as wealthy.”

Also supporting the tax credit is Success Academy Charter Schools Founder and CEO Eva Moskowitz.

“We must give parents every means possible to escape failing schools and choose better ones. Lifting the cap on charter schools will help. Tax credits will help. Governor Cuomo is taking a critical step forward in achieving these goals,” said Moskowitz.

Calls to Assembly speaker Carl Heastie on the subject were not returned.

On the senate side, Brooklyn State Senators Simcha Felder and Marty Golden introduced and saw passed a similar bill giving tax credits to those donors giving to non-public schools.

A senate source said while Cuomo’s bill is similar to the Felder-Golden bill, it has some different provisions. The senate is looking at Cuomo’s bill now, the source said.