Following revelations of massive missteps and allegations of fraud against victims of Hurricane Sandy, GOP Staten Island District Attorney and 11th Congressional District candidate Dan Donovan today called for comprehensive reform of the Federal Emergency Management Agency’s National Flood Insurance Program (NFIP).

Donovan’s initiatives come on the heels of national media reports detailing thousands of cases of alleged fraudulent home inspection reports being used to deny claims to policyholders who filed flood claims after Superstorm Sandy.

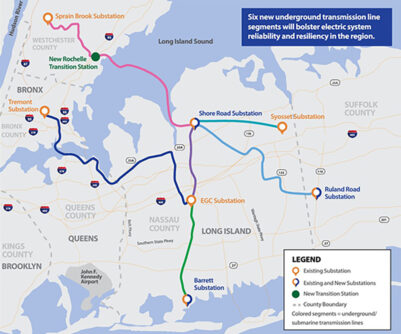

More than 2,000 victims have filed lawsuits in federal court alleging engineering companies responsible for home inspections doctored reports to minimize damage claims. FEMA is responsible for administering NFIP and overseeing the engineering companies who inspect homes after a disaster.

Donovan cited the bureaucratic morass of home inspections as one of the biggest frustrations victims have been forced to endure. Following Sandy, homeowners received multiple inspection visits from multiple agencies, including FEMA, HUD, the New York City Department of Buildings and the Build it Back Program.

In many cases, the agencies did not communicate with each other, reports from the different agencies were lost or contained conflicting information and there was no centralized location for all involved parties to review the inspection.

Thus, Donovan proposed broad reform of the NFIP that would include new regulations on the way home inspections are conducted. This includes:

-

After a flood event, there should be one home inspection conducted by a FEMA agent or FEMA certified engineer, and include a video or photos to document everything. That information should be available to any of the involved parties via a web page. This eliminates confusion and the opportunity for wrongdoing.

-

Homeowners should be made to sign an affidavit detailing the damage. That way if there is something in dispute, for instance whether damage occurred prior to the flood or not, the homeowner is given the benefit of the doubt and if he/she is lying that constitutes fraud. This would mirror the Build it Back program approved by HUD.

-

FEMA should eliminate penalties to the insurer for “overpaying,” thereby eliminating the incentive to underreport damages.

-

There should be a mandatory audit to ensure accountability and prevent fraud

“FEMA’s National Flood Insurance Program needs a dramatic overhaul,” said Donovan. “The first nightmare people had to go through was the storm itself, then the process of dealing with flood insurance has been a whole new nightmare. We are just starting to see the first wave of home affordability crisis flood insurance will cause, as tens of thousands of homeowners in New York City alone will see their premiums rise dramatically, while others will be forced to take out unaffordable policies for the first time. It’s unconscionable that after everything victims have gone through after a disaster, the federal government has made it worse.”

Donovan said given that Staten Island and South Brooklyn were so heavily impacted by Sandy, that if elected, he would spearhead disaster recovery reform in Washington.

“God forbid we have another disaster, no one should have to go through the process this way again. These reforms will go a long way toward streamlining the claims process, making it more efficient for victims, as well as FEMA and the insurers,” he said.

Donovan is running against Democratic Bay Ridge City Councilman Vinnie Gentile. The special election is May 5.