Levine Warns New Yorkers About Emergence of B.1.1.7 in New York

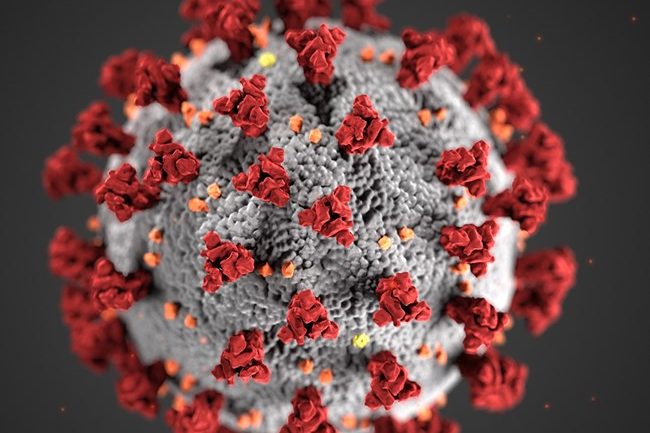

Councilmember Mark Levine (D-Manhattan Valley, Manhattanville) posted a tweet last Saturday warning his followers about the spread of B.1.1.7, a new variant of COVID-19, in New York City.

B.1.1.7, first identified in the United Kingdom, is a far more infectious strain of the virus. As of yesterday, New York has had 42 confirmed cases of the new strain, putting it third in the U.S. behind California and Florida.

“There’s been shockingly little reporting on the variant in NYC, but the # of cases of B.1.1.7 detected is steadily increasing,” said Levine. “And we’re still seeing 5k+ new covid cases/day in NYC. Less than 2% of NYers have gotten their 2nd vaccine shot. This remains a moment of great peril.”

Johnson Announces Legislative Plans to Reform NYPD

Last Friday, Council Speaker Corey Johnson (D-Chelsea, Hell’s Kitchen) announced that the Council will introduce a new legislative package aimed at reforming the New York City Police Department and strengthening police accountability.

The package is in compliance with an executive order that Governor Andrew Cuomo (D) enacted last June, mandating that the City will adopt a police reform plan by April 1. Hearings will begin on Feb. 8, and the proposals will be introduced on Feb. 11.

“This legislative package will be just one of the steps the City Council is taking toward reforming policing,” said Johnson. “It is critical that we redefine public safety and reduce the NYPD’s footprint. From mandating that the Council confirm incoming police commissioners to ensuring non-carceral interventions to community safety, this legislation will bring much-needed transparency and accountability to New Yorkers.”

Nadler Seeks Answers on DOJ’s Prosecution of Capitol Insurrectionists

Last Friday, U.S. Rep. Jerrold Nadler (D-Manhattan, Brooklyn) sent a letter to Acting Attorney General Monty Wilkinson, demanding that the Department of Justice hold all of the Jan. 6 insurrectionists accountable for their actions, by any means necessary.

The letter was a direct response to reports that the U.S. Attorney’s Office was not pursuing charges against a large number of the insurrectionists who stormed the U.S. Capitol at the beginning of the month. Nadler is seeking the release of any documents pertaining to the investigative and prosecutorial guidelines related to these cases.

“It is critical that all of the perpetrators of this insurrectionist attack be identified, investigated, arrested, charged and subsequently prosecuted,” wrote Nadler. “The Department of Justice must dedicate every available resource to its offices across the country in order to ensure that all of these individuals are held accountable.”

Read the full letter here.

Schumer, Gillibrand Introduce Bill to Permanently Restore New York’s SALT Deduction

Last Friday, U.S. Senate Majority Leader Chuck Schumer (D) and U.S. Senator Kirsten Gillibrand (D) introduced legislation to repeal the cap on New York’s State and Local Tax (SALT) deduction.

In 2017, a new law was passed capping the SALT deduction at $10,000. The bill would allow taxpayers to fully deduct state and local taxes on their federal income returns, starting this year.

“When it comes to SALT, New York families needed and deserved this money before the coronavirus took hold, the stakes are even higher now because the cap is costing this community tens-of-thousands of dollars they could be using amid the crisis,” said Schumer. “That is why I am proud to be leading this legislation to restore our full SALT deduction. Double taxing hardworking homeowners is plainly unfair; We need to bring our federal dollars back home to the to cushion the blow this virus—and this harmful SALT cap—has dealt so many homeowners and families locally.”

“I am proud to join my colleagues to introduce legislation to repeal the cap on the State and Local Tax deduction, a cynical policy passed by Republicans as a way to repay wealthy donors and lobbyists with big corporate tax cuts,” said Gillibrand. “The reinstating of the SALT Deduction will ensure that New York families have more money in their pockets, get much-needed tax relief and will once again be treated fairly.”